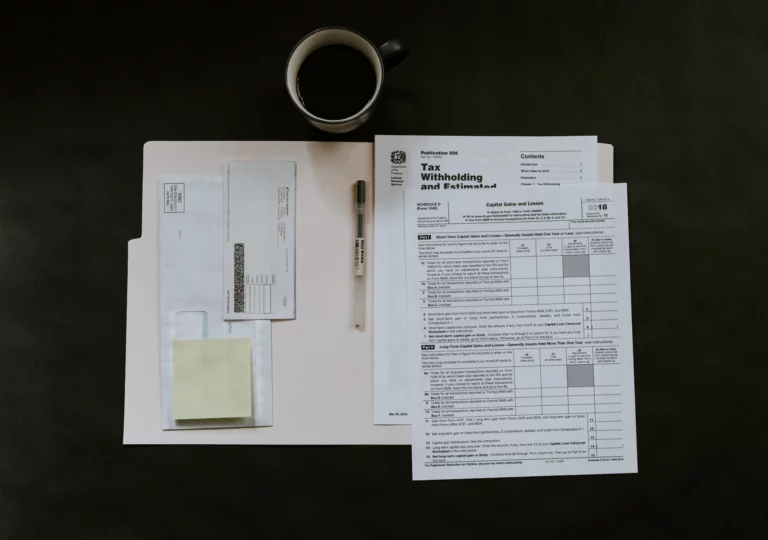

If you’re required to pay estimated tax payments, the IRS could charge you with an underpayment penalty if you pay too little, too late, or don’t have enough withheld from your wages. Accurately estimating your quarterly tax payments can be difficult, but in order to avoid getting fined, you’re required to pay at least 100% […]