Carry Solo 401k

A Supercharged Retirement Plan, Designed For Business Owners

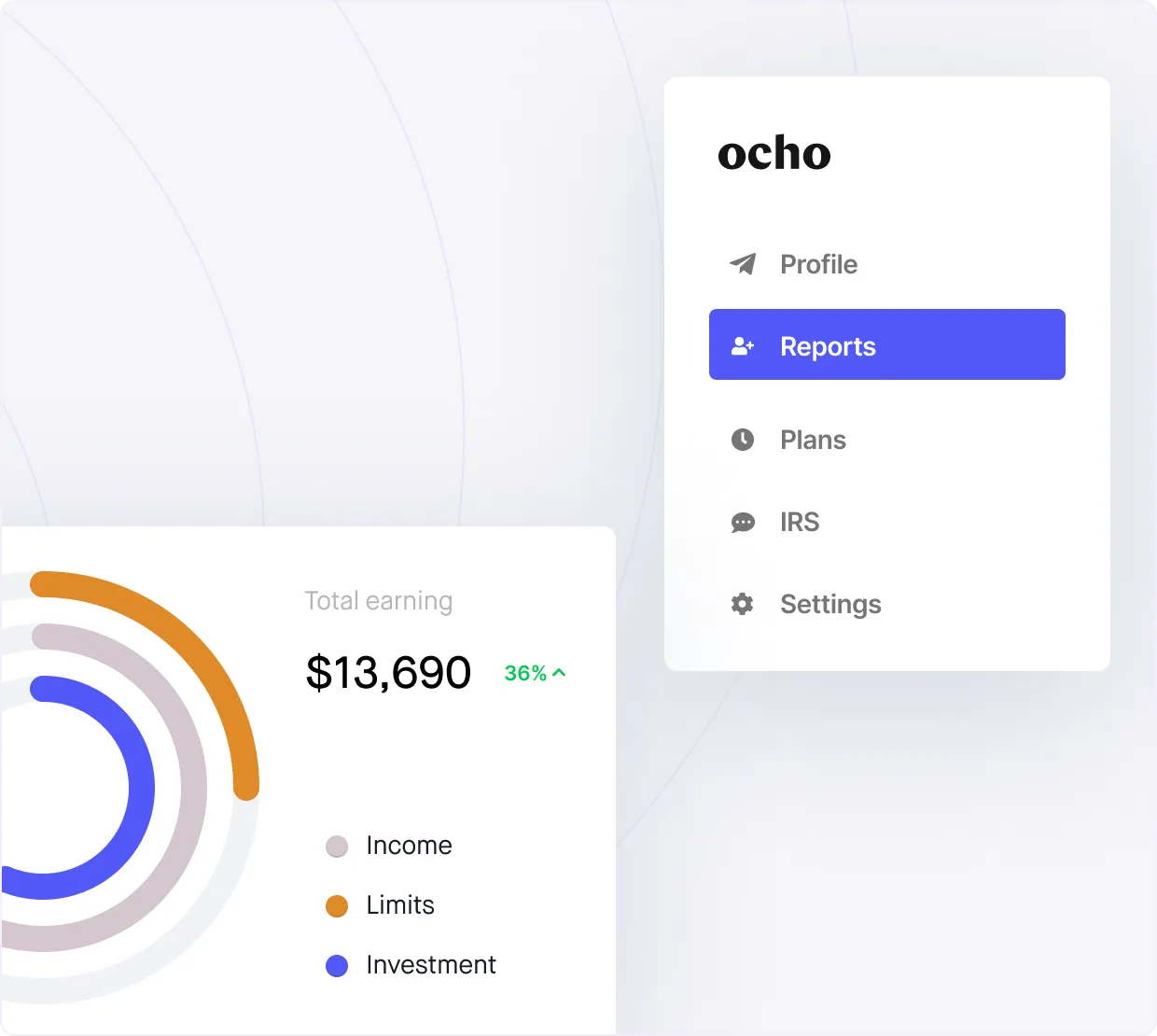

The Carry Solo 401k gives business owners the biggest tax advantages of any retirement plan. Contribute up to $61,000 and invest in any asset class with tax-free compounding. We meticulously crafted Carry to be the simplest, easiest solo 401k experience you’ll ever have. Create your account, make contributions, and invest your funds all in one place through our minimal, intuitive dashboard.

Why You Need to use Carry

An All-In-One Integrated Platform

Carry is the easiest way to set up a solo 401k and start investing your money with tax-free compounding. You can open an account in under 10 minutes, and we take care of all paperwork and administration for you. No need to open separate bank and brokerage accounts – it can all be done through your Carry account.

The Easiest Way To Invest In Alternative Assets

Invest in traditional assets like stocks, mutual funds, and ETFs, or take full checkbook control and directly invest your money in alternative assets like real estate, crypto, and private equity.

Pick and Choose Your Tax Savings Each Year

You get to decide whether you want to contribute with pre-tax dollars and get a tax deduction, or contribute into a Roth account for tax-free withdrawals in retirement. Deduct up to $61,000 from your taxable income, or put the whole amount into a Roth account. It’s entirely up to you.

The Biggest Roth Account Legally Possible

A mega backdoor Roth solo 401k lets you invest up to $61,000 entirely into a Roth account (10x more than a Roth IRA, and 3x more than what’s traditionally allowed with a 401k). A mega backdoor Roth is a complex procedure with many moving parts. With Carry, it’s 100% handled for you.

A Delightfully Easy Investing Experience

Create your account, make direct contributions, rollover assets, and invest your funds all in one place. And if you need help, we’re here for full account administration assistance, automated tax filings, and security u0026amp; compliance monitoring.

A Retirement Account Not Quite Like The Rest

Contribute up to $61,000 into an Carry Solo 401k for 2022. That’s 10x more than an IRA, and 3x more than a normal 401k. Invest in any asset class (including crypto, NFTs, real estate, and startups) with tax-free compounding, and never pay any fees for your assets under management. Enjoy all the benefits of the Carry Solo 401k for just one low yearly fee.

Highest Contribution Limits

The Carry Solo 401k has the highest contribution limits of any retirement account ($61,000 for 2022 – $66,000 for 2023).

Total Investment Freedom

Invest in any asset class including stocks, ETFs, crypto, NFTs, real estate, or private equity.

Tax-Free Compounding

Pay zero taxes on any income or profits generated from your investments. 100% of your profits go straight back into your account.

A Supersized Roth Account

With a Roth account, withdrawals in retirement are completely tax-free. Contribute up to $20,500 into an Carry Roth Solo 401k for 2022.

Largest Tax Deductions

You can get a tax deduction of up to $61,000 for 2022 by making your entire contribution with pre-tax dollars.

Full checkbook control

Get full checkbook control over your funds. You can write checks directly on your own without having to go through a custodian.

Mega Backdoor Roth

Carry has full support if you want to implement a mega backdoor Roth solo 401k, which allows you to put up to $61,000 into a Roth account for 2022.

Integrated Bank & Brokerage Accounts

No need to go out and open separate bank and brokerage accounts. Easily open any accounts you need within Carry.

Unlimited Rollovers

Fund your account by rolling over an unlimited amount of funds and assets from any other retirement plan that you already own (except a Roth IRA).

World Class Support

Rely on the Carry team to help you with any questions, administration support, annual tax-filings, and compliance monitoring.

Ready to get started with the Carry Solo 401K Plan?

It takes less than 10 minutes to open an account

Transparent pricing with no AUM fees

Unlike other money managers, we charge zero fees on your money under management (AUM) and do not receive any kickbacks from any products we recommend.

All income levels and all business entities eligible

Any business owner, freelancer, creator, or even full-time employees with a side hustle can open a solo 401k. The only requirement is that you have no full-time W-2 employees that work over 1,000 hours in your business (excluding your spouse). There are no income limits – you’re eligible whether you make over $1M or operate a small side hustle.

One plan that fits all your needs.

The Carry Solo 401k Plan Comes With

- Ownership of an Carry Solo 401k Plan.

- A Roth solo 401k account

- Security & compliance monitoring.

- Personalized investment plan & recommendations.

- Support for a mega backdoor Roth conversion.

- A delightfully simple all-in-one investment platform.

- Full onboarding support and account administration assistance.

- Integrated bank & brokerage accounts (coming soon).

- Rollover support from other retirement plans that you already own.

- Access to any investment options, with full checkbook control (coming soon).

Questions?

To be eligible for a solo 401k, you need any sort of business or self-employment activity, with no full-time W-2 employees that work over 1,000 hours in your business (excluding your spouse). Business owners with any type of business entity can open a solo 401k, whether you operate as a sole proprietorship, partnership, LLC, s-corp, or c-corp. You can still work with freelancers and contractors, but you lose eligibility if you have full-time W-2 employees.

Ocho Investment Advisors LLC (“Carry Advisors”) is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC), and uses bank-level security and state of the art encryption to keep your data and money safe. Brokerage and custody services are provided by DriveWealth LLC, a SEC registered broker-dealer and member FINRA/SIPC. SIPC, or the Securities Investor Protection Corporation, currently protects the securities and cash in your account up to $500,000 of which $250,000 may be in cash. SIPC does not protect against the market risks associated with investing. Investing in securities involves risk and there is always the potential of losing money. Asset allocation and diversification do not guarantee a profit or protect against a loss, and past performance is no guarantee of future results.

Additionally, like all 401(k) plans, your Carry Solo 401(k) is set up as a retirement trust, with you appointed as the sole trustee and plan administrator. In the unlikely event that Carry were to go out of business, your 401(k) and trust would remain in existence, and all funds would remain under your control. While Carry helps set up your solo 401(k) plan, you remain the plan administrator and trustee at all times, and Carry never has custody of your funds, meaning they are owned and titled by your 401(k) plan, not by Carry. If Carry were to close, you could choose to keep your money with DriveWealth (if you change to a new advisor) or transfer the assets to your bank account.

Apart from the flat annual subscription fee, Carry does not charge any additional fees or hidden charges, and there are no fees on your assets under management (AUM) when using the optional integrated brokerage account through Carry Advisors. You get all the premium features of Carry for one all-inclusive price. While Carry does not charge any additional fees apart from the flat annual fee, there may be fees charged by Drive Wealth, ETFs and funds you choose to invest in, and trading commissions. There may also be fees if you choose to invest through your solo 401(k) plan outside of the Carry application. Carry Advisory may also charge advisory fees at some point in the future, to future customers. Any changes to our fee structure will be communicated beforehand.

When you sign up for the Carry Solo 401k, you’re given three different accounts: Traditional (pre-tax), Roth (post-tax), and an after-tax account.

Contributions made to your traditional (pre-tax) account are tax-deductible. If you’re looking for the largest tax deduction possible, you can make all your contributions as pre-tax for the year and deduct up to $61,000 ($67,500 if age 50+) for 2022 and $66,000 ($73,500 if age 50+) for 2023.

For comparison, contributions made to your Roth (post-tax) account are not tax-deductible but allow you to take tax-free withdrawals in retirement. The after-tax account is a special-use account that we have solely for executing the mega backdoor Roth solo 401k.

When you sell assets in your account for a profit, you don’t pay any capital gains taxes. Instead, 100% of your earnings go straight back into your solo 401k account where it can get reinvested.

For example, if you invest in a rental property through your solo 401k, all profits earned from rental income are tax-free – no capital gains taxes owed. If you decide to sell the property, all profits from the sale are also tax-free*.

For 2022, you can contribute up to $20,500 into your Roth solo 401k. If you’re at least 50 years of age, you can contribute up to $27,000.

For 2023, you can contribute up to $22,500 into your Roth solo 401k. If you’re at least 50 years of age, you can contribute up to $30,000.

Carry also supports the mega backdoor Roth solo 401k, which allows you to contribute more money into your Roth solo 401k than is typically allowed. If you perform a mega backdoor Roth solo 401k with Carry, you can contribute up to $61,000 ($67,500 if age 50+) for 2022 and up to $66,000 ($73,500 if age 50+) for 2023. If this sounds confusing to you, don’t worry – we’ll help guide you through it.

There’s no need to take your plan docs and go searching for a third party that will accept your solo 401k plan documents (unless you want to!). Easily open any accounts you need within Carry*.

When you sign up for a solo 401k plan, you get access to the optional integrated brokerage account. Additionally, you can use the solo 401k to open separate, third party bank and brokerage accounts, if you wish to invest in alternative assets or through a different investment advisor or brokerage.

As the plan administrator, participant and trustee of your plan, you will have full checkbook control over any third party accounts and can write checks and wire funds directly when you want to make an investment. For example, if you want to buy crypto, you would open a new account with an exchange using your solo 401k plan trust as the owner, and fund your account using your solo 401k bank account. If you want to invest in a startup, you would simply write a check from your solo 401k plan trust bank account. We will assist with the account opening process if you require any information or help using your plan documents to open a third party account*.

If you have any other questions that weren’t answered here, contact us anytime by clicking on the chat bubble icon at the bottom right corner of your screen.

Trusted and backed by the world’s top entrepreneurs, creators and money experts.

“The level of insight you get in terms of your money management is not something I’ve seen on any other apps I’ve used.”

3500

Early Stage Users

100+

Startup founders have invested in Carry

$5M+

In preseed funding

Built by the team that built: