Carry Solo 401k

A Completely Reimagined Solo 401k Experience

All about Solo 401k...

What is a Solo 401k?

What are the benefits?

Who is eligible to open one?

Does a Solo 401k save you on taxes?

Who can open up a Solo 401k?

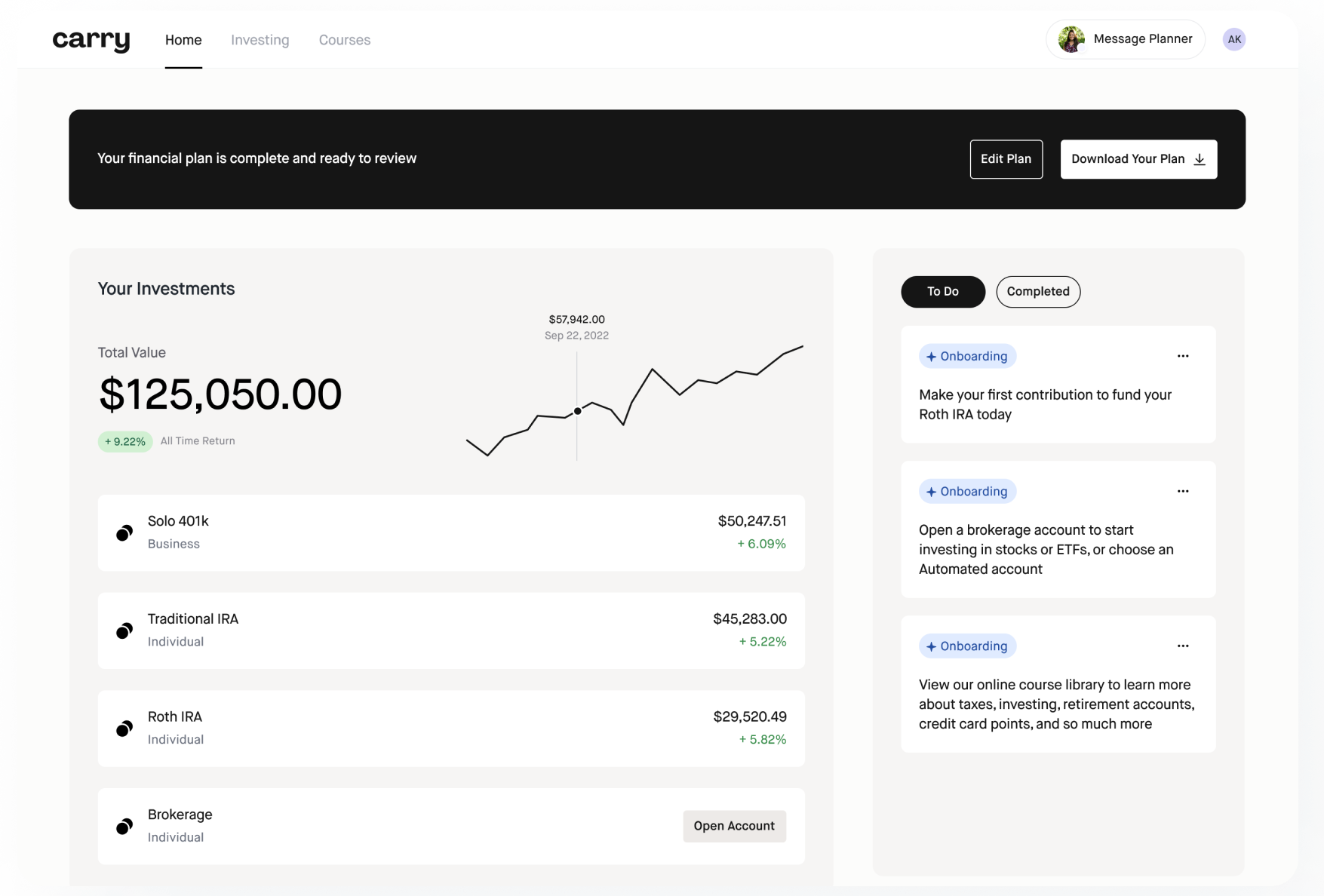

Ready, set, done in 10 minutes or less

Say goodbye to paper forms and waiting weeks for plan approval. With Carry, you can set up your plan, deposit money, invest, take out loans, or rollover funds straight from your dashboard in under 10 minutes.

Bigger Tax-Saving Features,

More Automations

What can you do with a Carry Solo 401k?

Invest In Alternative Assets

In addition to stocks, mutual funds, and ETFs, the Carry Solo 401k makes it super simple to invest in alternative investments like crypto, real estate, and private startups. And if you’re not sure how it works, we’ll show you exactly how to do it, step-by-step.

Save & Invest on Autopilot

Prefer hands-off investing? The Carry Solo 401k comes with the option to automate everything. You can set up recurring deposits and investments, and your Solo 401k can grow entirely on autopilot.

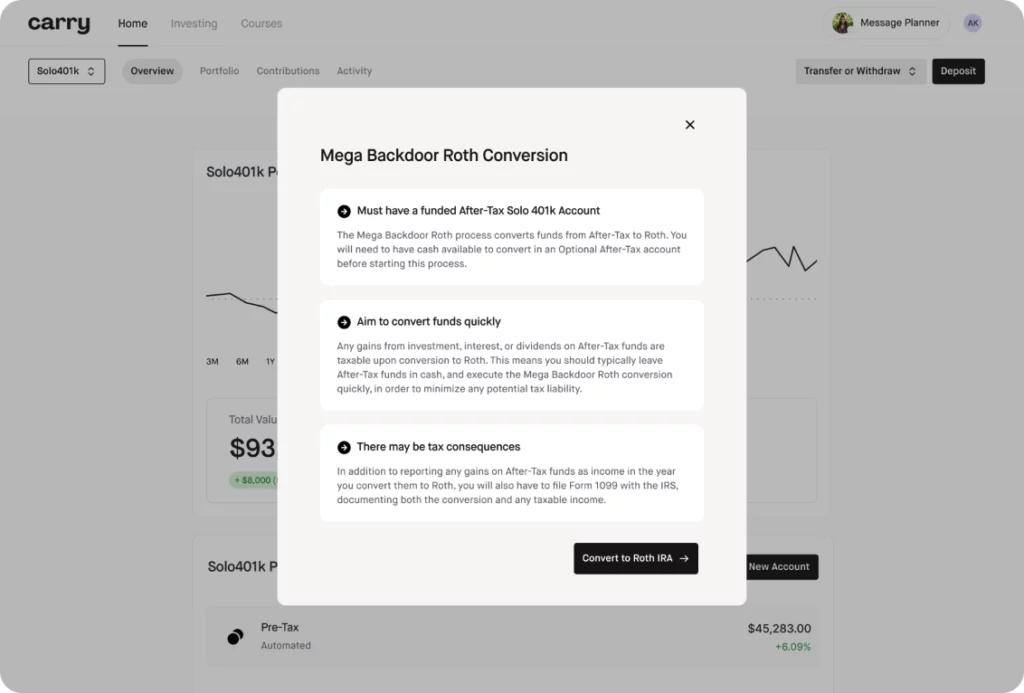

Mega Backdoor Roth (in Clicks)

The mega backdoor Roth conversion allows you to put away up to $66,000 entirely into your Roth Solo 401k for 2023. One of the most complex tax strategies can now be done with just a few clicks, in under 10 minutes.

Borrow up to $50,000 from your account

With the Carry Solo 401k, you can borrow up to 50% of your account value up to $50,000. No credit checks, no lengthy application processes, and you can use the funds for whatever you like as long as you pay it back within 5 years.

Zero AUM Fees

Carry’s mission is to save you money on taxes, and help you build more wealth into retirement. Charging AUM fees achieves the opposite of that. And that’s why we eliminated them completely.

The help you need, when you need it

Navigating retirement plans is a critical matter that deserves the highest levels of customer support. We make sure every Carry customer is in compliance, up to date with IRS regulations, and informed to make important tax-saving decisions in a timely manner.

Ready to get started?

Unlock our Limited Time Offer:

2023 Tax Saver Bundle

(ENDS Novemeber 19)

love for carry

Don’t just take our word for it

READY TO GET STARTED?

Join today and get our special offer.

Sign-up for any Carry plan before November 18 and get access to our premium Tax Saving Strategy course ($499 value).

Basic Plan

-

Carry Solo 401k, IRAs & Brokerage Accounts

-

Security and Compliance Monitoring

-

No AUM Fees

-

30-day Refund Guarantee

-

BONUS: 2023 Tax Saving Strategy Course

Pro Plan

-

Everything Included on Basic Plan plus:

-

Chat with Financial Advisor

-

Custom Financial Plan

-

No AUM Fees

-

30-day Refund Guarantee

-

BONUS: 2023 Tax Saving Strategy Course

Carry VIP

Limited spots and by application only.Per Year

-

Everything Included on Pro Plan plus:

-

Hands-on Financial Planning and Execution

-

No-fee Investment Management and Advice

-

Sourcing, Vetting, and Executing on Boutique Accredited Investments

Try Carry for 30 days and if it isn’t for you, get fully refunded – no questions asked.

Your questions answered

Common questions

Who is eligible for a Solo 401k?

Any business owner, self-employed individual, freelancer, or side-hustler is eligible to open a solo 401k plan if they have no employees, including part-time employees who have reached 21 years of age, and have worked over 500 hours per year for 3 consecutive 12-month periods (excluding their spouse). You’re eligible even if you have a full-time job with other retirement plans, as long as you earn side hustle income (even just $1).

Do you have a refund policy?

Yes! You’ll have 30 days from joining Carry to request a full refund, no questions asked.

How long do I have access to the platform for?

Your membership will give you access to Carry for one year and will renew annually after that. You will always be able to cancel before the next payment cycle.

Are my funds with Carry safe?

Ocho Investment Advisors LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC), and uses bank-level security and state of the art encryption to keep your data and money safe. Brokerage and custody services are provided by DriveWealth LLC, a SEC registered broker-dealer and member FINRA/SIPC. SIPC, or the Securities Investor Protection Corporation, currently protects the securities and cash in your account up to $500,000 of which $250,000 may be in cash. SIPC does not protect against the market risks associated with investing. Investing in securities involves risk and there is always the potential of losing money. Asset allocation and diversification do not guarantee a profit or protect against a loss, and past performance is no guarantee of future results.

Additionally, like all 401(k) plans, your Carry Solo 401(k) is set up as a retirement trust, with you appointed as the sole trustee and plan administrator. In the unlikely event that Carry were to go out of business, your 401(k) and trust would remain in existence, and all funds would remain under your control. While Carry helps set up your solo 401(k) plan, you remain the plan administrator and trustee at all times, and Carry never has custody of your funds, meaning they are owned and titled by your 401(k) plan, not by Carry. If Carry were to close, you could choose to keep your money with DriveWealth (if you change to a new advisor) or transfer the assets to your bank account.

What if I have other questions?

Email us at support@carrymoney.com and we’d be happy to help answer them!