AS A BUSINESS OWNER...

There are so many things you can do to lower your tax bill.

But historically, the most impactful strategies have either been too complicated to set up or expensive.

SO WHAT'S THE SOLUTION?

Choose Carry.

There's a reason why so many business owners prefer Carry.

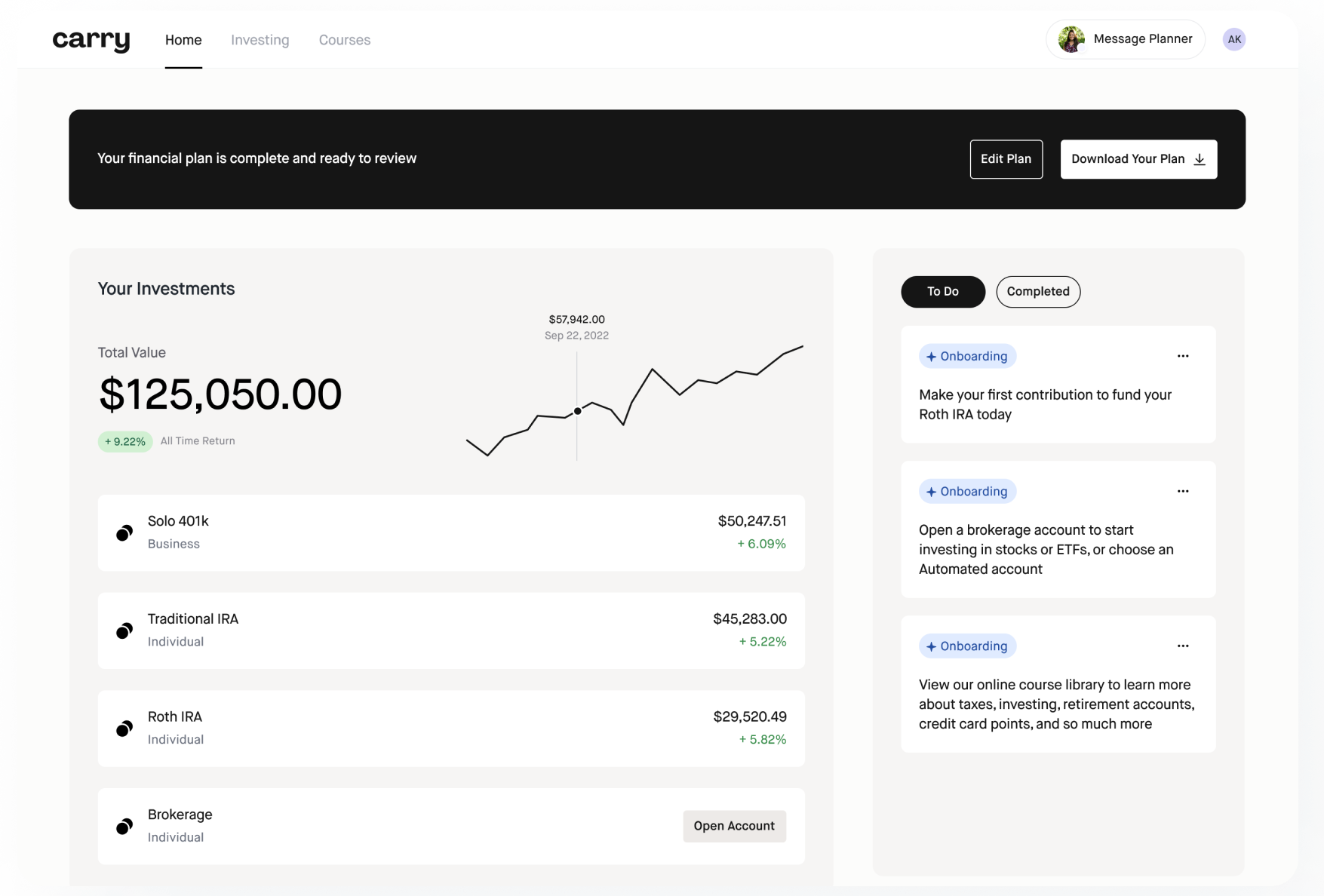

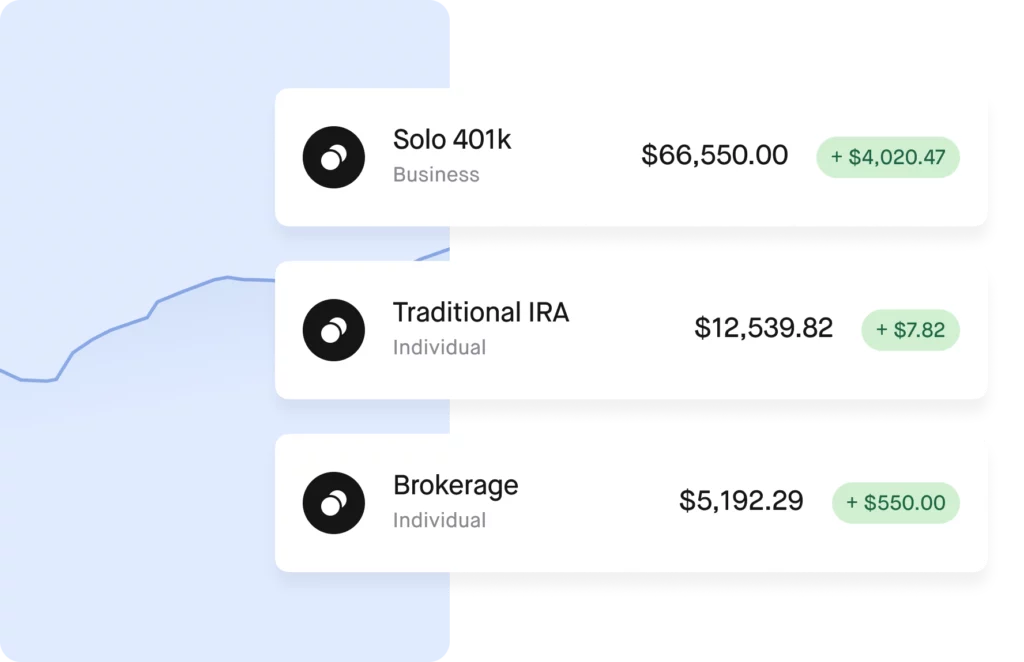

Solo 401k + Other Powerful Investment Accounts

Set up and manage your Solo 401k, IRAs, and brokerage accounts under one roof (all without AUM fees.)

Cash Balance Plans and Donor Advised Funds are in the pipeline too!

Setup Recurring Contributions

In a matter of seconds, it’s easy to setup recurring contributions to any of your accounts (yes, even the Solo 401k!).

Mega Backdoor Roth (in Clicks)

Do things like a Mega Backdoor Roth and Regular Backdoor IRAs in clicks. And unlike every other provider, no tedious process or faxing forms (like it’s 1999).

Speak with a Financial Advisor*

Not sure where you should be allocating your money? Have questions based on your unique situation? On our Pro Plan, you can chat with an advisor at anytime!

(*On Pro Plans only)

Ready to get started?

Join Carry today.

love for carry

Don’t just take our word for it

Ready to get started?

Plus, your subscription counts as a business expense!

Basic Plan

-

Carry Solo 401k, IRAs & Brokerage Accounts

-

Security and Compliance Monitoring

-

No AUM Fees

-

30-day Refund Guarantee

-

Eligible business expense (for your taxes)

Pro Plan

-

Everything Included on Basic Plan plus:

-

Self-directed IRAs

-

Chat with Financial Advisor

-

Custom Financial Plan

-

No AUM Fees

-

30-day Refund Guarantee

-

Eligible business expense (for your taxes)

Carry VIP

Limited spots and by application only.Per Year

-

Everything Included on Pro Plan plus:

-

Hands-on Financial Planning and Execution

-

No-fee Investment Management and Advice

-

Sourcing, Vetting, and Executing on Boutique Accredited Investments

Try Carry for 30 days and if it isn’t for you, get fully refunded – no questions asked.

Your questions answered

Common questions

Do you have a refund policy?

Yes! You’ll have 30 days from joining Carry to request a full refund, no questions asked.

How long do I have access to the platform for?

Your membership will give you access to Carry for one year and will renew annually after that. You will always be able to cancel before the next payment cycle.

What if I have other questions?

Email us at support@carrymoney.com and we’d be happy to help answer them!

Are my funds with Carry safe?

Ocho Investment Advisors LLC (“Carry Advisors”) is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC), and uses bank-level security and state of the art encryption to keep your data and money safe. Brokerage and custody services are provided by DriveWealth LLC, a SEC registered broker-dealer and member FINRA/SIPC. SIPC, or the Securities Investor Protection Corporation, currently protects the securities and cash in your account up to $500,000 of which $250,000 may be in cash. SIPC does not protect against the market risks associated with investing. Investing in securities involves risk and there is always the potential of losing money. Asset allocation and diversification do not guarantee a profit or protect against a loss, and past performance is no guarantee of future results.

Additionally, like all 401(k) plans, your Carry Solo 401(k) is set up as a retirement trust, with you appointed as the sole trustee and plan administrator. In the unlikely event that Carry were to go out of business, your 401(k) and trust would remain in existence, and all funds would remain under your control. While Carry helps set up your solo 401(k) plan, you remain the plan administrator and trustee at all times, and Carry never has custody of your funds, meaning they are owned and titled by your 401(k) plan, not by Carry. If Carry were to close, you could choose to keep your money with DriveWealth (if you change to a new advisor) or transfer the assets to your bank account.

Can I add my spouse to my plan?

Yes! Also, adding your spouse can double the annual Solo 401k contribution limits for your household.

Your spouse will need to purchase their own separate Carry Solo 401k, and we’ll add them to your plan. You and your spouse will each have your own Carry accounts and logins, to keep your funds and investments separate, but both accounts will be tied to the same Solo 401k Plan.