Now in Beta!

Building wealth for business owners

Carry is everything you need to build wealth as an entrepreneur, freelancer, consultant or independent business owner. We exist to serve entrepreneurs with the tools, education and network to transform their business income into generational wealth.

Setting up your Solo401k takes less than 10 min

$66k

Annual tax deductions

$22.5k

Annual Roth limit

0%

Taxes on Roth withdrawals

Personal Finance, Engineered For Business Owners

Carry is the product we wish we had when building our first businesses. The Carry Solo 401k is a supercharged retirement plan for business owners. Carry Money is an exclusive community and academy that teaches entrepreneurs, freelancers and creators how to level up their finances.

Retirement Account

Carry Solo401k

The perfect retirement plan for business owners, with no fees on your assets under management. Comes with the largest possible tax deductions, a super-sized Roth account, and the ability to invest in any asset class with tax-free compounding. Opening a solo 401k has never been easier – it only takes 10 minutes to get started.

Education

Carry Money

Level up your finances as a business owner by learning directly from the best subject matter experts. Carry Money is a collection of courses, live workshops, and community to master your personal finances as an entrepreneur.

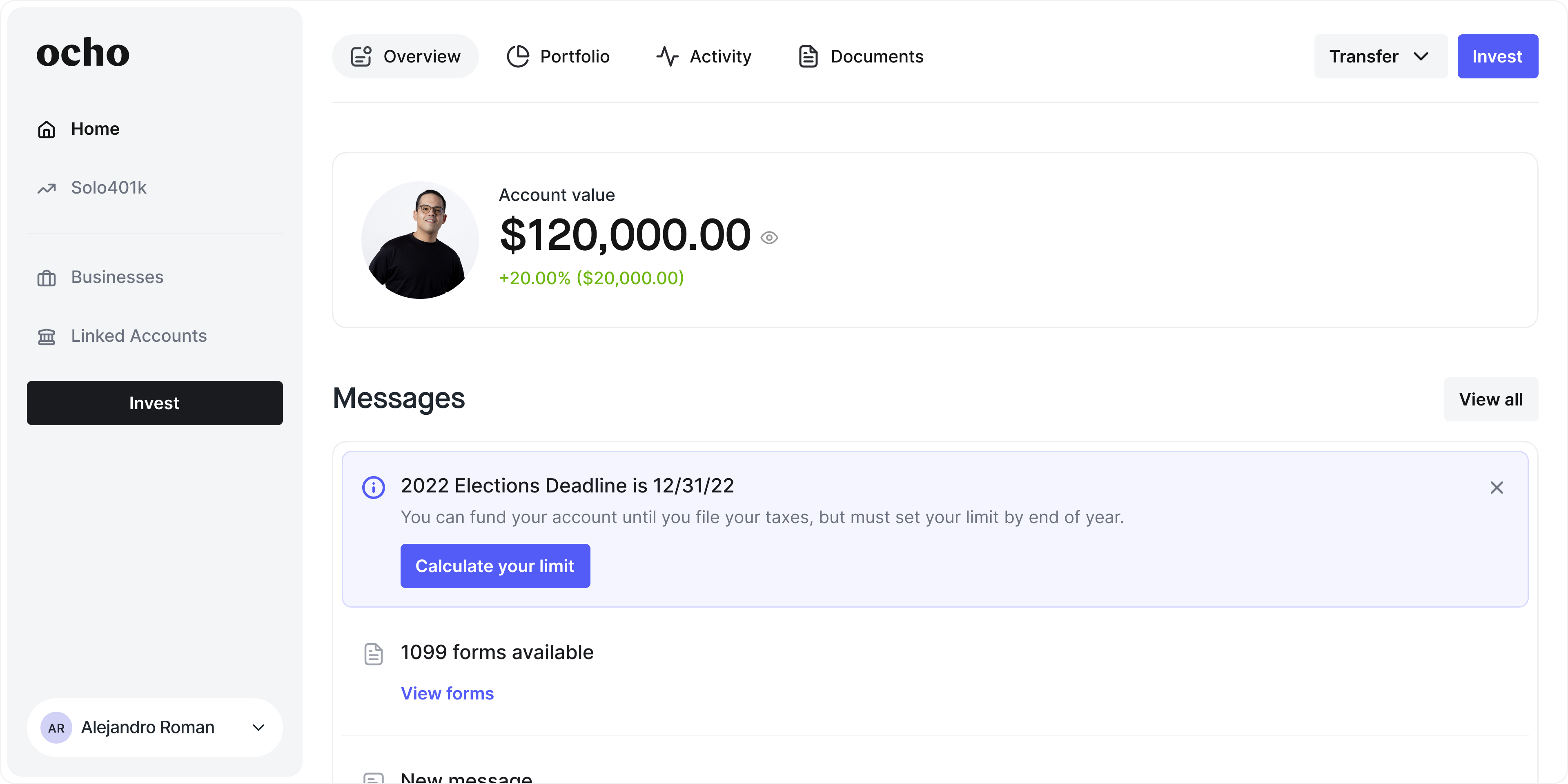

All in one platform with a seamless user experience

Carry is the easiest way to set up a solo 401k and start investing your money with tax-free compounding. Make contributions, open bank and brokerage accounts, and view investment reports all through our beautiful, intuitive user dashboard.

Total investment freedom. Invest in stocks, mutual funds, and ETFs or alternative assets like crypto, real estate, and private equity. (coming soon)

We’re committed to protecting your account with state-of-the-art encryption to keep your data and money safe.

IRS rules can be confusing. We keep track of all your contributions and make sure you’re in compliance, so you don’t have to.

Open an Carry Solo 401k Plan in under 10 minutes.

Get instant access to the Carry Solo 401k for one low price. No hidden fees, no fees on your money under management. Once you open your account, you’ll be able to immediately make contributions, rollover funds, and invest your money in any asset class.

One plan that fits all your needs.

What’s you will get

- Ownership of an Carry Solo 401k Plan.

- A Roth solo 401k account

- Security & compliance monitoring.

- Support for a mega backdoor Roth conversion.

- Full onboarding support and account administration assistance.

- Integrated brokerage accounts.

- Rollover support from other retirement plans that you already own.

- Access to any investment option, with full checkbook control (coming soon).

Why Carry?

Trusted and backed by the world’s top entrepreneurs, creators, and money experts.

100+

Startup founders have invested in Carry

$5M+

In preseed funding

Built by the team that built: