Step 1: Download E-book

Step 2: Unlock Full Course

Don't let finance mistakes derail your startup – get the full course + tools for just $1

Try it risk-free for 7-days (and keep everything for just $29/month after that).

No thanks, I don't want access to the course >>

Get the Full Course + Carry Platform (Try it for $1)

Here’s what you’ll get in this $1 week trial:

- The “Startup Finance” Course: Demystifies equity, smart fundraising, exit strategies, and more.

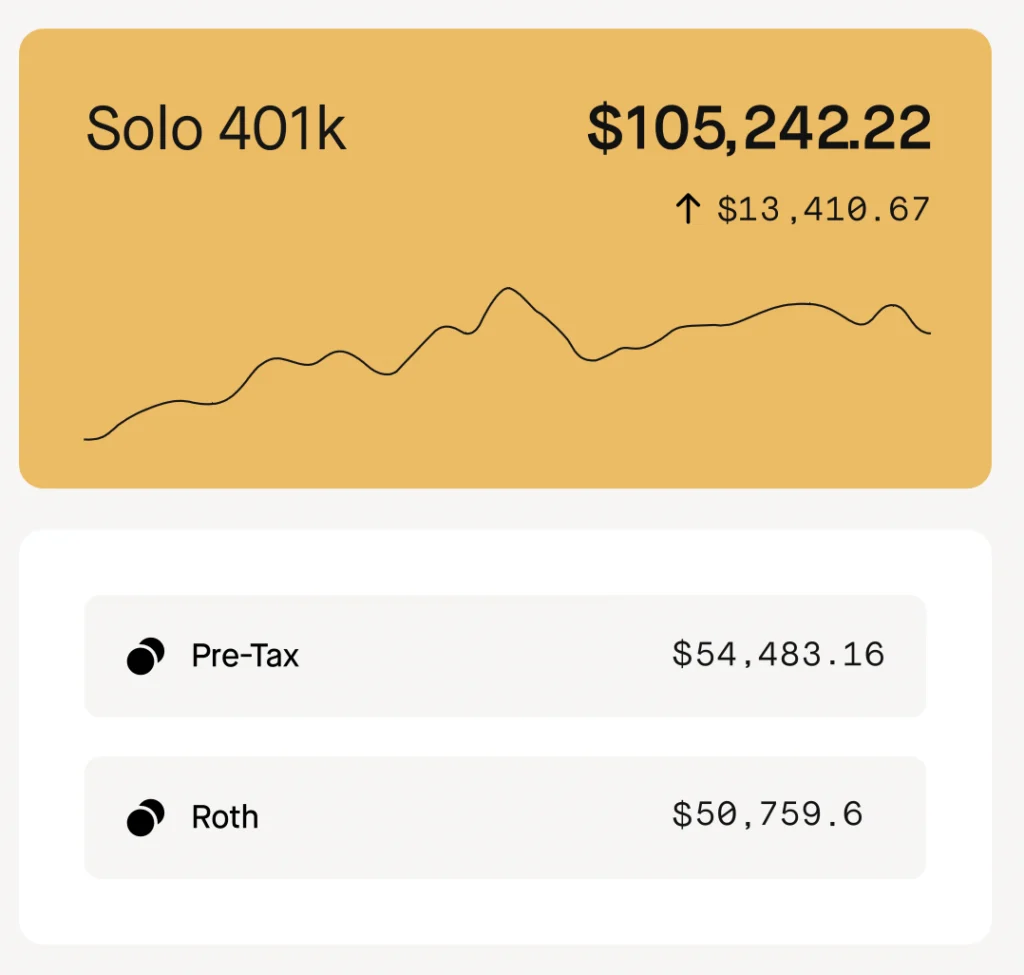

- Carry Platform for Tax Savings: Set up powerful accounts like Self-directed IRAs and Solo 401ks (up to $69,000 deduction for 2024).

- Invest With Ease: Stocks, ETFs, alternative assets – no AUM fees.

- Expert Help: Live Q&As, financial planning, resources, and our full course library!

- 30-day money-back guarantee.

Risk-free 7-day trial; renews at $29/month post-trial; cancel anytime.

Why Entrepreneurs Love This Combo

You’re worried about taxes, equity, finding the balance between paying yourself and growing… and proving to investors that you’ve got the financial chops to take your company to the next level.

This Gives You the Edge

Most founders are experts in their product, not finance (and generic advice won’t cut it). This course gives you the startup-specific knowledge plus the Carry platform to simplify taxes and investments – the perfect combo to build your net worth.

Try it all for just $1

Risk-free 7-day trial; renews at $29/month post-trial; cancel anytime.

You solved the use case that matters most. 🙏🏽 If I wasn't running my own startup, I'd want to work with you all.

She crafted for me a 32-page tax and financial plan that outlined insurance, retirement, and how to achieve my my LT goals.

Kudos, @ankurnagpal and @carryhq_ squad!👏

What makes this $1 trial a no-brainer?

-

Personal finance tailored for entrepreneurs

Ditch generic personal finance advice and learn strategies tailored to your founder journey like QSBS and other strategies to keep more of your hard-earned money. - Premium Course Hub: Get access to even more great courses inside of our library of premium personal finance courses tailored specifically for you as a business owners. Learn powerful tax saving strategies, how to master credit card points & miles, investing, and more!

- Simplify your finances with the Carry platform: Access accounts designed to minimize your tax burden (like Solo 401ks), access stocks, ETFs, and alternative assets – with no AUM fees.

- Get a custom financial plan & chat with a planner◊ If you join Carry's Pro plan, you'll also get access to a custom financial plan and ability to chat with a financial planner directly in the platform! ◊

- And more!

This Course is for you if...

- You're worried that taxes are eating away your profits (but can't justify or afford paying thousands of dollars to a fancy accounting/legal team to optimize things)

- Maybe you're worried about losing control of your company due to poorly structured equity agreements (but have no idea what you should be looking out for or doing)

- You might even be struggling to find the balance between paying yourself fairly and fueling your company's growth

- Or maybe you want to be the founder investors TRUST with their money (but need to learn how)

If this sounds like you, this course is going to help.

It’s also everything I have learnt about money and personal finances — and a playbook for the knowledge I wish I had when I was building and selling my first business.

Try it and see for yourself.

EVERYTHING YOU GET

Choose a Carry Plan

Carry is our all-in-one platform for tax-advantaged accounts, investments and strategy for business owners.

Seamlessly setup a Solo 401k (the most powerful retirement account in America)

The Carry Solo 401k gives business owners the largest tax advantages of any retirement plan. Contribute up to $69,000 and invest in any asset class with tax-free compounding.

If you own a business or have a side hustle (with no employees), you’re likely eligible for a Solo 401k. Dollar for dollar, this beats out every retirement account in size and flexibility:

- Up to a $69,000 tax deduction ($76,500 if over 50)

- Tax-free growth and compounding

- Invest in any asset class you like

- Supports Roth contributions, including Mega Backdoor Roth

- Borrow from your plan at any time

Build and manage your investment portfolio

We’ve built a brokerage within every Carry account, allowing you to invest in stocks or ETFs without incurring any AUM fees.

Not sure what to invest in? Our Automated accounts create a smart portfolio tailored to your age and risk tolerance.

Simply set up a recurring contribution, and we’ll handle everything else. Plus, the cash in your account is FDIC insured and your securities are safeguarded by SIPC, up to their respective limits.†

Diversify with alternative investments

Unlike traditional brokerages, Carry lets you to use your retirement dollars to invest in a variety of alternative assets. This includes crypto, real estate, private companies, venture and private equity funds, and more.

You can also use tax-advantaged Roth accounts to compound your wealth by investing in these assets directly from your IRA or Solo 401k.

* Pro plan only

Receive up to a $1,500 tax credit (EACA)

The Eligible Automatic Contribution Arrangements (EACA) is a small business tax credit offering $1,500 in tax credits to anyone with a Solo 401k Plan with auto-contributions enabled.

This means that you can set up a Solo 401k Plan with Carry, with auto-contributions enabled, and receive $500/year in tax credits for the first 3 plan years.

Tax write off with your Carry subscription

Another perk of being a business owner! Your Carry plan subscription is also an eligible business expense for your taxes.

FDIC insured †

With Carry, the cash in your account is FDIC insured and your securities are safeguarded by SIPC, up to their respective limits.†

Who you'll learn from

Hey, I’m Ankur Nagpal 👋🏽

I’m a second-time startup founder. After building and scaling my first company, Teachable, to a successful exit, I turned my focus to helping other founders with their finances.

- Built a multi-million dollar Facebook app business from my dorm (and learned a harsh tax lesson).

- Founded Teachable, scaled it to $250M acquisition, sparking my passion for startup finance.

- Launched Vibe Capital, an $80M venture fund, investing in 80+ tech startups.

- Now leading Carry, on a mission to help business owners build wealth through smart financial/tax-saving strategies.

Try the "Startup Finance" Course + Carry Platform for $1

What's included:

Try everything risk-free for 7-days (and keep it for just $29/month after that)

Entire “Startup Finance” Course (taught by Ankur Nagpal)

- Access to a bonus course hub (with even more great courses to dig into)

Plus…

- Carry platform (any plan): Access accounts designed to minimize your tax burden (like Solo 401ks), access stocks, ETFs, and alternative assets – with no AUM fees.

- Custom financial plan & chat with a planner (Pro plan only).

- 30-day money-back guarantee.