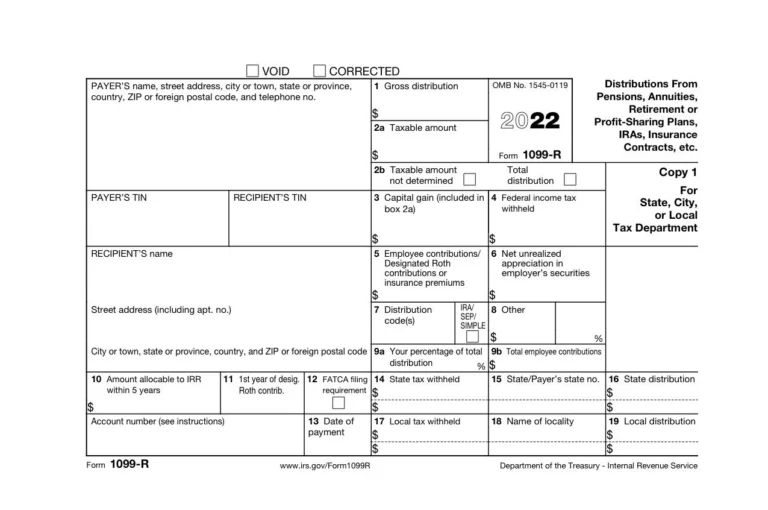

A Roth IRA is completely funded with after-tax dollars you’ve already paid incomes taxes on. The money in your account compounds tax-free, and withdrawals in retirement also never get taxed. While the contribution limits of a Roth IRA are fairly low compared to other retirement accounts (like the solo 401k), the withdrawal rules are more lenient. Every retirement […]